A step‑by‑step guide to opening your first chart, placing your first trade, and using a simple, repeatable strategy.

Contents

What Is Forex Trading?

Forex (foreign exchange) is the global market where currencies trade in pairs (e.g., USD/CAD). The price constantly changes as one currency strengthens or weakens against the other.

Quick example: If $100 USD converts to $138 CAD today and you expect USD to strengthen (so the conversion rises), you’d look to buy USD/CAD. If you expect USD to weaken (so the conversion falls), you’d sell USD/CAD.

You’re not buying stacks of bills, you’re speculating on price movements of a currency pair on a chart.

How Do You Profit in Forex? (Buy vs Sell)

Every trade has two key protections:

- Stop‑Loss (SL): The price where the trade is wrong and you exit at a controlled loss.

- Take‑Profit (TP): The target where you secure gains.

If you buy and price moves up to your TP before hitting SL, you win. If you sell and price moves down to your TP, you win. Simple—but you must be consistent.

The Exact Tools You Need (All Free to Start)

- Charting & Analysis: [TradingView] — create a free account. Use the Superchart and add your watchlist.

- Order Execution: MetaTrader 4 (MT4) desktop/mobile. Connect it to your broker account (start with a demo to practice).

- Authenticator / 2FA: Secure your brokerage account and withdrawals.

Set‑up flow: TradingView for analysis ➜ MT4 to place trades.

TradingView quick start

- Go to tradingview.com → Get started for free → sign up.

- Open Products → Supercharts.

- Click Watchlist → + → choose Forex → Source (e.g., OANDA or your broker’s feed) → add pairs (see next section).

MT4 quick start

- Create demo or live account with your broker.

- Download MetaTrader 4 (desktop) from your broker portal.

- Log in → Market Watch shows pairs → New Order to buy/sell or set Pending Orders (limits at your planned levels).

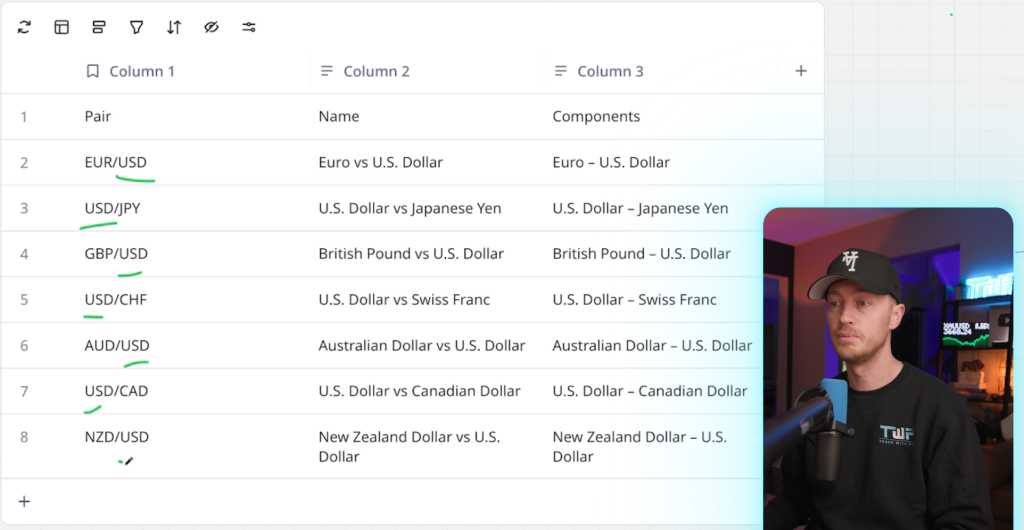

Which Forex Pairs Should Beginners Trade?

Start with the majors (pairs that include USD). They’re liquid, tighter‑spread, and cleaner technically:

- EUR/USD

- GBP/USD

- USD/JPY

- AUD/USD

- USD/CAD

- USD/CHF

- NZD/USD

Seven pairs are plenty. Scan for the cleanest setups—if nothing’s there, come back later.

When to Trade: Sessions That Actually Move

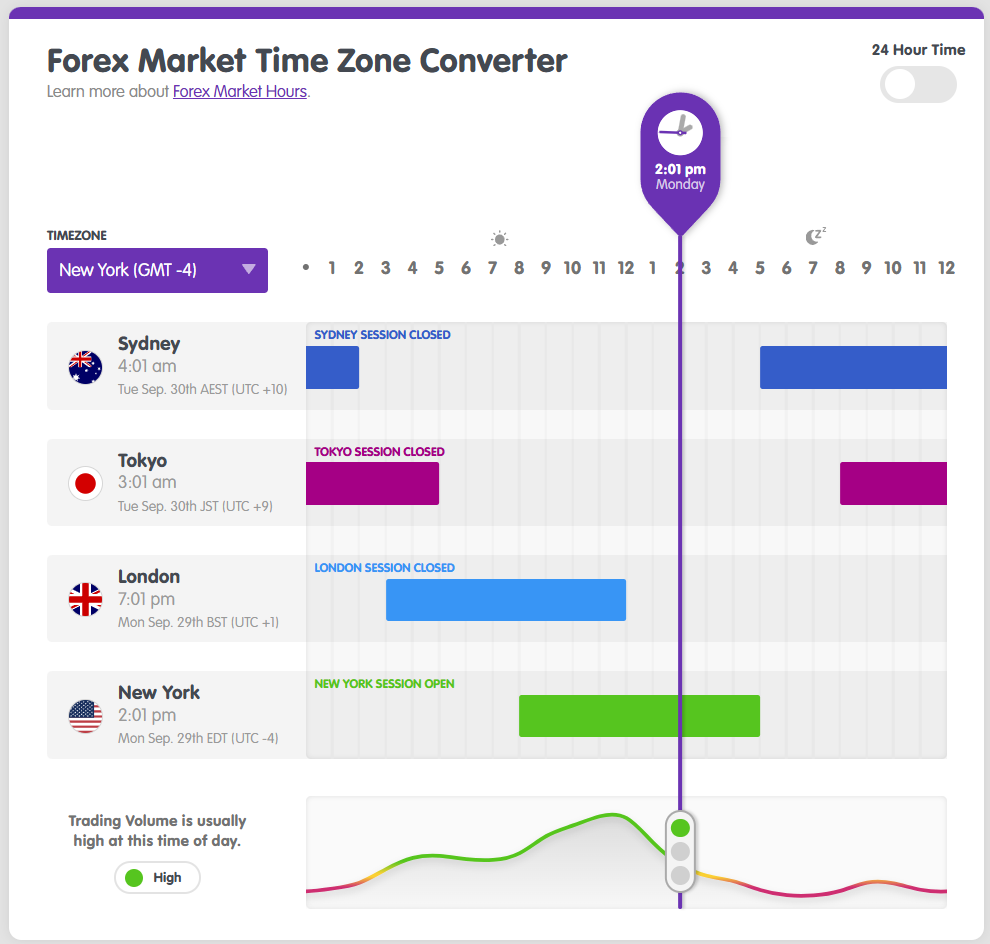

The market runs 24/5, but volatility clusters in these sessions:

- London (often strongest trends)

- New York (great momentum; overlaps with London)

In TradingView, add the “Trading Sessions” indicator to see Tokyo (blue), London (orange), New York (green). As a beginner, pick one session and master it.

Here is the Forex Market hours page for you to analyze.

New York sample schedule (Eastern Time):

- Start: ~9:15–9:30 AM

- Focus: 9:30–11:30 AM

- Stop: after your plan completes (avoid over‑trading)

Technical Analysis 101 (No Overwhelm)

We’ll keep this lean and effective:

1) Trend Filter — 50 EMA

Add an Exponential Moving Average (EMA). A simple rule:

- Price above EMA → look for buys

- Price below EMA → look for sells

2) Supply & Demand

A strong impulsive move (big push) reveals where larger players acted. The base of that move is a demand zone (for buys) if price launched upward, or a supply zone (for sells) if price dropped sharply.

3) Support & Resistance (S/R)

Former resistance that’s broken can become support on a retest (and vice‑versa). Combine S/R with demand/supply and the EMA filter for high‑probability pullbacks.

The core idea: Wait for a pullback to a high‑quality level in the trend direction, then define SL/TP before you click anything.

My 2025 Trading Model (NY & London)

This is the opening‑range pullback model I use on stream.

Timeframes used:

- M15 (15‑min) to define the Opening Range

- M5 (5‑min) to monitor breaks and plan the entry

Step A — Mark the Opening Range

- New York: Mark the high/low of the 9:30–9:45 AM ET M15 candle.

- London: Mark the high/low of 8:15–8:30 UTC M15 candle.

Add an Opening Range indicator in TradingView and set the exact minutes so it plots automatically.

Step B — Decide Direction

- If M5 closes above the range high → bias long.

- If M5 closes below the range low → bias short.

- Align with the overall trend via the EMA.

Step C — Plan the Entry

Look left for the nearest quality level in line with your bias:

- Demand (for longs) or Supply (for shorts)

- A clean S/R retest

- (Optional) Fair Value Gap or midline of the range

Place a limit order at the chosen level, with SL beyond the zone.

Step D — Manage & Exit

- TP: Prior swing, range extension, or 2R–3R target.

- Consider partial profits at 1R and move SL to breakeven once structure confirms.

- If SL is tagged, you lose 1R (by design). Next.

Real result examples from my stream include ~+3% to +6% wins risking 1% per trade. Losses happen—your edge is discipline + risk control, not prediction.

Risk Management in Plain English

- Risk per trade: 0.5%–1% of account balance.

- Position size: Back‑solve from SL distance so your dollar risk = 1R.

- Daily max loss: 2R–3R. Stop trading if hit.

- News filter: If red‑folder news is scheduled for your pair/session, stand down.

Trader psychology (what actually derails people)

- Be a contrarian when the chart says so. Don’t outsource your brain to headlines or friends.

- No political bias. Trade the chart, not your feelings about who’s in office.

- If you have a gambling impulse, pause. Over‑trading and revenge trades kill accounts.

How to Avoid High‑Impact News Days

Use an economic calendar (e.g., filter to high‑impact only). If your session is packed with red events for USD, CAD, GBP, JPY, AUD, etc., skip or reduce size. Fewer trades, cleaner conditions.

Complete Beginner Checklist

- Create TradingView account and add the 7 major pairs

- Add Trading Sessions + Opening Range + 50 EMA

- Open MT4 demo with your broker; learn market vs pending orders

- Pick one session (NY or London) and stick to it for 30 days

- Practice the Opening‑Range Pullback model

- Risk ≤1% per trade; obey a daily max loss

- Avoid red‑folder news days for your pair

- Journal screenshots: thesis, entry, SL/TP, result, lesson

FAQ

Is Forex good for beginners in 2025?

Yes—if you keep your tools simple, risk small, and focus on one session and one model. The barrier to entry is low, but the discipline requirement is high.

Which pair should I start with?

Pick one major (EUR/USD or USD/JPY are popular) and learn its rhythm before adding more.

What time frame is best?

This model uses M15 to frame the session and M5 to execute. As you gain experience, you can align with H1/H4 for bigger context.

How much do I need to start?

On demo, $0. On live, small accounts are fine if your risk is %‑based and you’re patient.

How often will I win?

Wins and losses come in streaks. Focus on process quality and R‑multiples, not win‑rate alone.

Free Room & VIP Signals

I send free trade ideas with full analysis to my public room (tens of thousands follow along). If you want my personal signals daily, consider joining VIP. Both links are available wherever you found this post.

Reminder: No guarantees. Results vary by discipline, execution, and market conditions. This is an educational blueprint—you provide the consistency.

ForexRobotNation.com – Best Forex Robot & Expert Advisor Reviews Forex Robot, Expert Advisor

ForexRobotNation.com – Best Forex Robot & Expert Advisor Reviews Forex Robot, Expert Advisor