If you trade gold, or want to start, I’ve got two trading strategies I use consistently to grow my accounts and manage a VIP trading room with over 1,000 members. I’m giving them to you absolutely free.

I’ve been trading for 16 years and I stream my trades live every week in front of thousands of traders with a verified win rate of over 82%. All the streams are still up on YouTube, so you can verify that for yourself.

Now, I’m not promising or guaranteeing that you’ll get results like mine. But I do hope you find one or two ideas in these gold strategies that you can add to your own trading plan.

Contents

2 Gold Trading Strategies (Video)

Here is the full video explaining the gold trading strategies in FULL detail:

Strategy 1: Support, Trendlines & Breakouts

We start with day trades and swing trades using support and resistance.

Step 1: Set up your support and resistance zones on the M30 or H1 timeframe. For example, on the H1 chart, you’ll often find a level that has acted as both support and resistance multiple times. That’s your key area. Once identified, wait for the price to pull back to that zone—your point of interest.

Step 2: Move to the M5 timeframe and draw a trendline that touches at least two or three points. This trendline will usually contain price until the breakout. When price breaks and closes above that trendline, it’s your cue that market structure is shifting.

Step 3: Wait for the retest of that trendline or confirmation with an engulfing candle. Enter your trade at that retest. For example, I entered a trade and shared it in my VIP Gold Room, with targets clearly set. After the trade moved in our favor, I moved the stop-loss to break-even and secured partial profits.

Step 4: Set your stop-loss just below the support zone. For your take-profit, look for a nearby fair value gap or area of previous consolidation that could act as resistance. You can also use the Fibonacci extension tool to find an exit—many traders aim for the 0.5 level for TP1. Once that’s hit, move your stop-loss to break-even and let the rest ride.

In one of the trades I shared, we smashed TP2 for a gain of 2,219 pips and a 1.8% gain on the account. That trade was copied directly through the trade copier I offer for free.

Strategy 2: ORB + Fibonacci Pullbacks

Let’s move on to one of my favorite strategies: the Opening Range Breakout (ORB) combined with smart Fibonacci pullbacks.

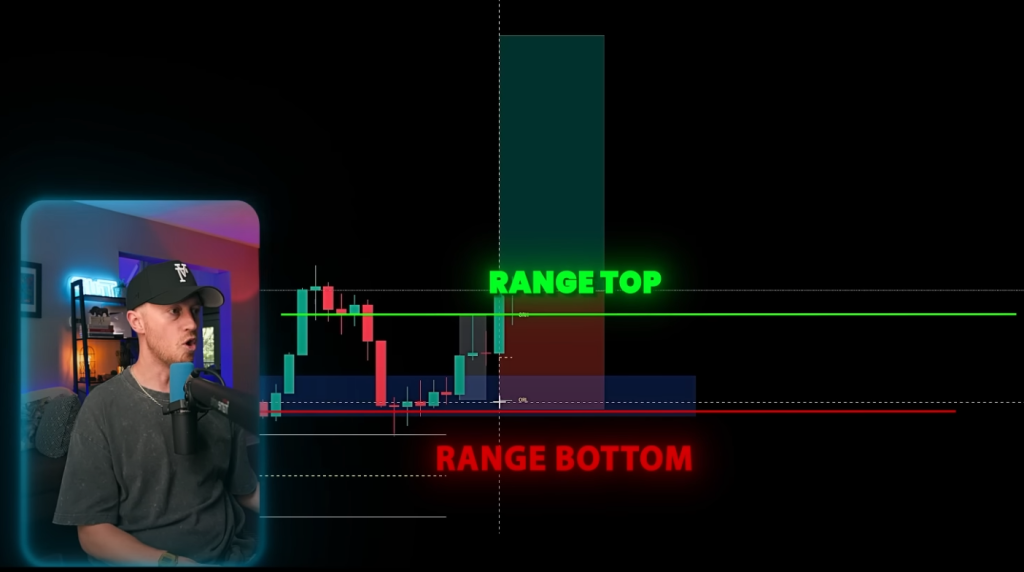

Step 1: Set your chart to the 15-minute timeframe and identify the 9:30–9:45 AM New York candle (UTC -4). This defines your opening range. Mark the high and low of that candle.

Step 2: Move to the M5 timeframe and wait for a break and close above or below the range. A break and wick isn’t enough—you need a full candle close. That break tells you the direction of the day.

Step 3: Set up support and resistance. Then, apply your Fibonacci from support to resistance. You want to enter at a discount—anything below the 50% line. As price pulls back toward support, this gives you a solid buy opportunity.

Step 4: Look for confluence like a trendline break or fair value gap. In one trade, I spotted a gap and placed a limit order at that level. Once price entered the fair value gap, it triggered my buy, smashed TP1, and I moved the stop-loss to break-even to secure the trade.

Managing the Trade: Set your stop just below the range or the most recent wick. Use the Fibonacci extension again to find your take-profits. I like using the 0.5 and 1.0 levels. Once TP1 is hit, always protect your gains.

Bonus: Lux Algo ORB Tool & My Trading Robot

If you want to speed up your setups, check out the Lux Algo ORBs and Targets tool on TradingView. It automatically draws the opening range high and low for you. I’ve even tested entries using this tool, including some without a pullback, those can work too, if the breakout is strong enough.

Also, I’ve been working on a Forex trading robot to test my strategies automatically. It runs entries based on my rule set and is already showing great results, back-to-back winners using these strategies. Once it’s polished, I’ll be releasing it for free.

Final Thoughts

These are the two gold strategies I personally use to run my VIP trading room. I hope they help you on your trading journey. If you want to join that room or try the trade copier, the links are in the description.

Like the video, drop a comment, and check out the next one right here. Much love, see you next week.

ForexRobotNation.com – Best Forex Robot & Expert Advisor Reviews Forex Robot, Expert Advisor

ForexRobotNation.com – Best Forex Robot & Expert Advisor Reviews Forex Robot, Expert Advisor