Put your credit card away. In this case study I test popular free Forex Telegram signal groups to see if they can actually grow a trading account. No promises. No guarantees. Just a transparent three-week trial, verified results, and honest conclusions.

Contents

What Are Free Forex Telegram Signals?

Free Telegram signal channels post trade ideas such as the pair or instrument to trade (gold, NASDAQ, EUR/NZD), entry direction, suggested stop loss, and take profit. The idea is simple: you follow the alert and execute the trade.

The problem is simple too: quality varies a lot. There are skilled traders sharing ideas and there are people guessing. This experiment puts claims to the test.

I’ve been running my Free Forex Signals trading room for 4 years, so join it here if you’re interested.

How I Ran the Test

- Providers: 10 free Telegram signal channels found via a Google search

- Account: $3,000 starting balance on a live account

- Execution: A copier attached to the account to mirror signals automatically

- Duration: 3–4 weeks

- Verification: Results tracked with Myfxbook and daily P&L logs

Reminder: This content is educational only. I am not promising or guaranteeing results.

First Look at the Signals

Some channels looked sensible, using support and resistance or trend continuation ideas. Others claimed unrealistic outcomes such as “guaranteed pips monthly,” which is not possible. I included them all so the data could speak.

I also re-tested a well-known provider from earlier in the year, Annabelle Signals. My previous experience was negative, but this was a fresh trial.

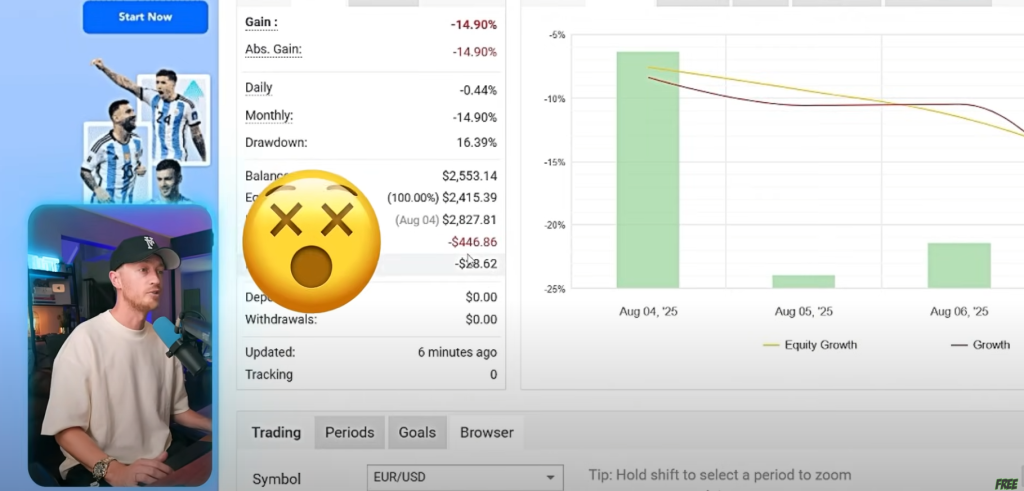

Week 1 Results: A Tough Start

- Daily results: several losing days, one strong winning day

- Net after Week 1: about –$446 plus interest

- Win rate: 4 wins out of 10 trades (40%)

- Average win: $30

- Average loss: –$94

The risk to reward was weak. Losing days outweighed the gains, and many losses were larger than the wins.

A Notable Win

Annabelle posted a USD/JPY short based on a clear resistance level and a trendline break on the 4-hour chart. The trade delivered roughly 140 pips, adding $94 on the $3,000 account. The analysis used clean structure and recent price action. Good example of a thoughtful swing trade.

Week 2: Stabilizing Risk and Finding Bright Spots

By the second week, four out of the ten providers were net positive even though the overall account was still down.

- Net after Week 2: roughly –$616

- Win rate: ~41%

- Average win: $72

- Average loss: –$87

Risk management improved. There were still avoidable losses, usually when signals fought the higher-timeframe trend or entered directly into resistance.

Live Trade Highlights

- EUR/NZD Long (Pro Signals FX): Breakout with a clean demand retest and a trendline break. Hit take profit for about $125.

- GBPCAD Sell (Elite Trading Signals): Counter to local structure. Price reclaimed support and stopped out. About –$60.

- EJ Buy (Top Trading Signals): Weak breakout into resistance with a visible head-and-shoulders. Stopped out for about –$70.

Lesson: The best signals respected structure, traded with momentum, and entered from demand or supply zones. The weakest signals forced trades against trend or into nearby levels.

Week 3: Final Stretch and Wrap-Up

One final gold sell signal from Annabelle failed. It was counter-trend with no solid resistance, so the stop loss was hit.

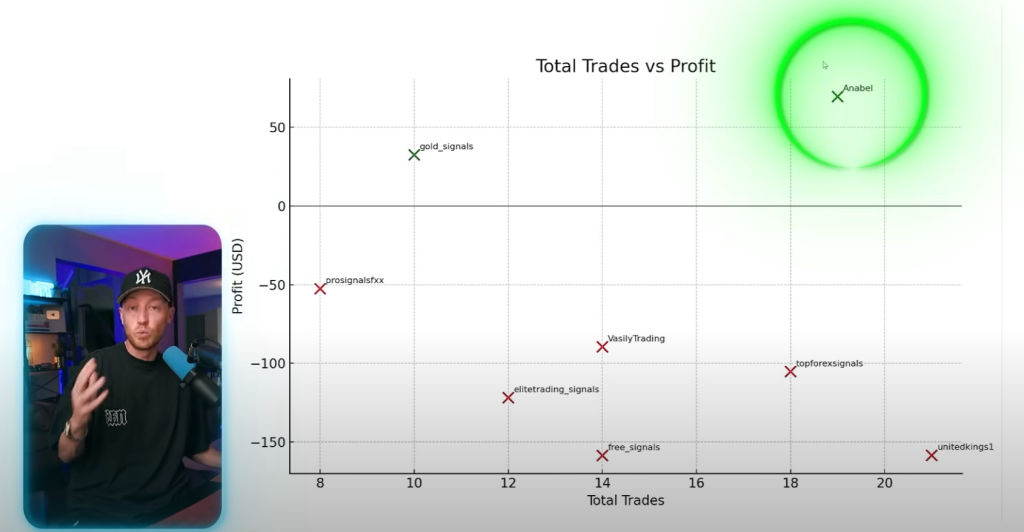

Final Verified Results

- Total signals taken: 116

- Final P&L on $3,000 account: –$584

- Overall win rate: 49%

- Average win: $47

- Average loss: –$55

- Providers positive: 2 out of 10

Top performer: Annabelle at +$69.58

Second: Gold Signals at +$32.50

I was surprised to see Annabelle finish first. Several of her swing trades used solid confluence and recent price logic.

All in all, paid Forex signals do seem to provide a much better result, as you would expect given when monetary incentive is involved.

Can You Trust Free Telegram Signals?

Sometimes. Most free channels were not consistently profitable across three weeks. A small minority showed discipline and structure. Even then, selectivity and personal analysis improved outcomes.

How To Use Free Signals Safely

- Check structure first: Only consider trades that buy near support or sell near resistance with clear confirmation.

- Demand and supply: Prefer entries that retest a demand/supply zone or an opening range level.

- Trend alignment: Avoid counter-trend trades unless there is strong confluence and a tight invalidation.

- Risk management: Keep losses smaller than wins. Place stops beyond structure, not arbitrary numbers.

- Journal and verify: Track your results. Use third-party verification so emotion does not rewrite history.

Key Takeaways

- Most free Telegram signals are inconsistent over a multi-week sample.

- A few providers can add value, especially on higher-timeframe swing ideas that respect recent price action.

- Your own validation of structure, trend, and levels is the difference between random outcomes and a strategy.

FAQs

Are free Forex signals worth it?

They can be a starting point, but you need to validate each idea and manage risk. Treat signals as ideas, not instructions.

Why did the overall account lose if some providers were positive?

Winners were small and inconsistent. Losers were more frequent or larger. The blend resulted in a net loss.

What improved the results in Week 2?

Better selectivity and a tighter risk profile. Average win increased and average loss decreased.

Should I pay for signals instead?

Paid does not mean profitable. Test, verify, and analyze regardless of price.

Want my free trading ideas?

I post signals in my free room and teach the range and ORB strategy I trade live each week. Join the community, do your own analysis, and trade responsibly.

Much love.

ForexRobotNation.com – Best Forex Robot & Expert Advisor Reviews Forex Robot, Expert Advisor

ForexRobotNation.com – Best Forex Robot & Expert Advisor Reviews Forex Robot, Expert Advisor

You have good reviews and ChatGPT. I’m New trader