Are trading signal indicators legit, or are they just another empty promise? That’s what I set out to answer with a $3,000 live trading account, 5 full days of testing, and a whole lot of honesty.

Watch the full video here:

Contents

What Are TradingView Signal Indicators?

Signal indicators are tools traders add to their charts, usually in platforms like TradingView, to get automated buy and sell signals. These tools are wildly popular, with tens of thousands of traders relying on them daily. The promise is simple: let the indicator tell you when to buy or sell, and profit. But does it actually work?

Choosing the Best Signal Indicator

To begin the test, I went into TradingView’s community scripts and looked for indicators that actually provided clear entry signals, not just visual aids or trend filters. After testing several, UT Bot Alerts stood out. It had over 27,000 users, clean visuals, and most importantly, buy and sell signals.

I adjusted the settings slightly—Key Value at 4, ATR Period at 10—and loaded it up. Then I funded a real, live trading account with $3,000 and connected it to MyFXBook for transparency.

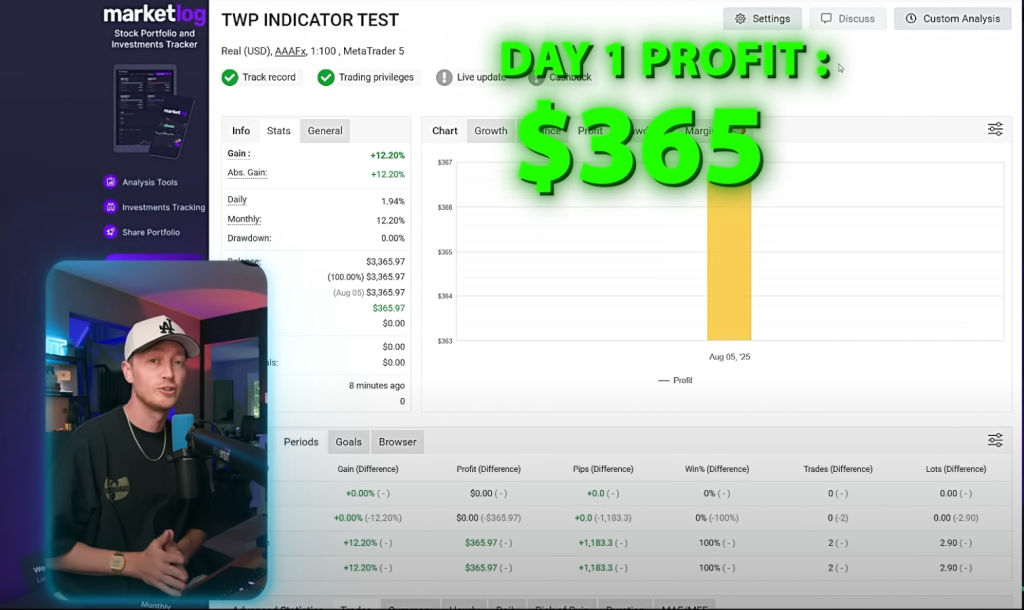

Day 1 – Strong Start with Manual Help

I traded on the 5-minute timeframe using gold (XAU/USD) and AUD/CAD. I combined the indicator signals with my own market structure analysis, support/resistance levels and trendline breaks. This sort of analysis serves me incredibly well in the Forex signals I give out in my VIP telegram room.

Gold trade: +$235

AUD/CAD trade: +$130

Total profit for the day: $365

The catch? I wasn’t blindly following the indicator. I was doing real analysis before every trade. So the question remained: is the indicator doing the work, or am I?

Day 2 – Blind Signal = Big Loss

To answer that question, I started trading purely based on the indicator—no personal analysis. The result?

One losing trade: -$162

Balance now: $203 in profit

I also began backtesting pure indicator signals and found a win rate of only 47% when used without any manual confirmation.

Day 3 – The Harsh Reality of Blind Trading

On day three, I followed the indicator blindly again. Two trades, two losses. Both triggered near resistance levels—a rookie mistake if you’re reading the chart.

Finally, I broke my own rule and jumped back in with a manual setup, aligned with supply and demand zones, and it paid off. That trade hit take profit perfectly.

When I used technical analysis with the indicator, I was able to hit an 87% win rate in my backtesting.

Day 4 – Full Auto… Full Pain

I gave full control back to the indicator for a day.

4 losses in a row

Account now at -$355

Conclusion? Never trust a signal blindly. The market punishes the lazy and rewards the informed.

Day 5 – Beach Trading and a Comeback Attempt

I tried to bring some beachside vibes into the challenge. Poor WiFi made that difficult, but the trade I had running continued into Monday (Day 6). I used my usual resistance/support and trendline structure to guide the trade and:

Trade hit TP: +$173

Final account balance: – $181

Despite the win, I ended the challenge down.

Final Verdict: Are Signal Indicators Worth It?

Signal indicators can assist your trading, but they are not a substitute for skill. Here’s what this test revealed:

Blind signals = inconsistent and unprofitable

Signals + technical analysis = powerful combo

You need to understand market structure, support/resistance, and price action to truly profit.

If you don’t have the skills to do either, consider a trading robot, like Forex FURY.

Takeaways for Traders

If you’re just slapping indicators on a chart and clicking “Buy,” you’re gambling. But if you use tools like UT Bot Alerts as part of a well-thought-out strategy, you can increase your win rate, reduce emotional mistakes, and grow your account.

Want to learn how to combine signal indicators with professional trading skills? Give me a follow on X:

👉 Join my free trading room

👉 Join my VIP group for real-time trades and mentorship

👉 Subscribe on YouTube for more content like this

MUCH LOVE!

ForexRobotNation.com – Best Forex Robot & Expert Advisor Reviews Forex Robot, Expert Advisor

ForexRobotNation.com – Best Forex Robot & Expert Advisor Reviews Forex Robot, Expert Advisor